If you are planning to find a job in Slovakia, we recommend that you select the type of work you are interested in. When choosing a suitable occupation, we recommend considering the actual jobs currently available within our labour market, occupations in which there are labour shortages, and your own qualifications and practical skills.

The Slovak job market primarily offers vacancies in the transportation, healthcare, and warehousing sectors, with ongoing demand for workers in the automotive and engineering industries. In the information technology sector, positions are available with the option to work from home, known as “HOME OFFICE.” Slovakia remains ready to employ doctors, nurses, medical assistants, and caregivers.

To succeed in the Slovak job market, having a well-prepared resume and various formal and informal recommendations from former employers, relatives, acquaintances, and friends will be beneficial. You should choose your job search strategy after considering the above factors.

You have the following options:

Searching for job offers on the internet is one of the most widely used and fastest ways of accessing the websites of public and private institutions with job offers. Some job portals also offer foreign language versions of their sites with the option to register resumes.

During a personal visit to the Offices of Labor, Social Affairs, and Family, you can contact EURES staff, who will assist you in finding job opportunities. If you are unemployed, Labour, Social Affairs and Family Offices can also offer various counselling services.

Job agencies can also help you to find a job. Please note that they may charge administration fees for their services in some situations.

Temporary employment agencies and supported employment agencies are another avenue you can explore when searching for work in Slovakia.

If you come across a job that is suited to you, you should respond as quickly as possible and send your CV and a cover letter using the contact details provided in the job advert. When you prepare these documents, make sure you do the best you can as this is your first contact with your future employer. In the current circumstances, we recommend that you do not hand in CVs personally to employers, but send them via email or post. Most recently, the SLOVENSKO SK portal, which operates in accordance with Regulation (EU) No 910/2014 of the European Parliament and of the Council, has also been used for sending out CVs and applying for jobs. The coordinated electronic services of SLOVENSKO SK are also available to EU citizens on the basis of coordinated electronic cooperation in the eIDAS system.

One of the best and most effective ways to find work is to contact employers by phoning them.

You will find the following websites particularly helpful when you are actively searching for work or need information about the job market:

Links:

| Ministry of Labour, Social Affairs and the Family | https://www.employment.gov.sk |

| Centre for Labour, Social Affairs and the Family | https://www.upsvr.gov.sk |

| Vacancies in Slovakia | |

| Central Public Administration Portal | https://www.slovensko.sk/en/title |

| Vacancies in EU/EEA countries | https://www.eures.sk |

| Job offers | https://www.profesia.sk |

| Job offers | https://praca.sme.sk |

| Job offers | https://kariera.zoznam.sk |

| Job offers | https://www.careerjet.sk |

| Job offers | https://www.studentservis.sk |

| Salary | http://www.platy.sk |

| National Health Information Centre | https://www.korona.gov.sk/en |

The most common way of applying for a job is to send a cover letter and a CV (curriculum vitae). A written job application is your first means of contact with a potential employer. Your application, along with your attached CV, serves as a calling card and personal advertisement, so you should prepare it carefully. Pay attention to the style, quality of expression and spelling. Avoid phrases and statements that are empty or have no meaningful value. Your application should be persuasive. It is meant to create interest in arranging an interview. It should be no longer than one sheet of A4 paper.

Structure of the application

In the header, state your contact details: your first name, surname, title, address, telephone number and email address (provide a formal email address consisting of your name and surname, not an email address such as superman gmail [dot] com (superman[at]gmail[dot]com)). Under the header, write the name and address of the employer, the place and the date. It is a good idea to state the name of the person in charge of recruitment.

gmail [dot] com (superman[at]gmail[dot]com)). Under the header, write the name and address of the employer, the place and the date. It is a good idea to state the name of the person in charge of recruitment.

The main body of the application should contain: the position you are applying for, where you heard about the job, why you are applying for that particular position. Briefly state your qualifications and skills for the position, your work experience or education, knowledge and skills that the potential employer could make use of, your work achievements supported by concrete examples, and when you would be available to start work.

At the end, write a polite sentence expressing interest in an interview. Sign the application by hand.

Don’t forget to attach your consent to the processing of your personal data so that employers can enter your application in their database.

Sample application

Adam Veselý , Hlavná 30, 040 01 Košice, tel. contact: 090X 123 456, e-mail: adam.vesely@

ABC, s. r. o

Severná trieda 72

040 01 Košice

Košice, 25.4.2024

Job application

Further to the advert you published in Korzár on 24 May 2022, I would like to apply for the position of international trade agent at your company.

After graduating from university, I worked as a sales representative at an international company for two years. I can communicate effectively in English, German and Spanish, both in writing and speaking. In my previous job, I actively used all these languages when communicating with foreign partners. I am proficient in typing and able to work well online and utilise standard MS Office applications. My strengths include flexibility, creative thinking, the ability to work in a team, resistance to stress, communication, presentation skills and creative approach to problem-solving.

I would be delighted to accept an invitation for an interview at a time convenient to you. Thank you in advance for considering my application.

In accordance with Act No 18/2018 on the protection of personal data and amending certain acts and Regulation (EU) 2016/679 of the European Parliament and of the Council of 27 April 2016 on the protection of natural persons with regard to the processing of personal data and on the free movement of such data, and repealing Directive 95/46/EC (General Data Protection Regulation), I hereby give consent to the employer (insert the employer’s official name), registration number: ABC, s.r.o., to manage, process and disclose all of the personal data provided in my personal profile, CV, cover letter and other attached documents related to my job application for the purposes of entry in the jobseekers register and recruitment. I declare that all of the personal data I have provided is true, correct and complete. This consent is voluntary and will remain valid for three years. This consent may be revoked at any time in writing.

Yours sincerely,

Attachments:

- CV

Links:

| Create a CV | https://www.eures.sk/vzor-zivotopisu-a-prakticke-rady-pri-pisani |

| Europass | https://www.eures.sk/europass |

| Create a CV and cover letter | https://www.zivotopis-online.sk |

| Create a cover letter | https://www.eures.sk/ako-napisat-motivacny-a-sprievodny-list |

Definition

There is no definition of ‘traineeship’ or ‘trainee’ in the Slovak legislation in force.

Traineeships do not constitute employment in the strict sense of the word. A traineeship is a form of gaining professional experience, working or volunteering. It gives trainees the opportunity to receive education, acquire and develop their skills, gain experience and competences and link theory with practice. A trainee can be a student, a graduate or anyone interested in a traineeship. A traineeship can potentially help the trainee to get a job. Those offering traineeships have the opportunity to test and get to know their future potential employee.

A traineeship is not a type of employment relationship. It refers to a specific activity that can be performed by the trainee on a full-time basis (intended especially for non-students) or part-time basis (used primarily by students).

A traineeship can take place on different legal bases. One of these is the ‘Unpaid Traineeship Agreement’ concluded with a company, organisation or institution in writing. It is used for traineeships that are not remunerated. For reasons of legal certainty and the need to define rights and obligations, a written form of agreement is recommended. An employer who decides to pay for the traineeship may conclude one of the agreements on work performed outside an employment relationship within the meaning of Section 223 of the Labour Code, namely:

- an agreement on casual student labour (suitable for students under 26 years of age)

- an agreement on the performance of work (also suitable for persons other than students)

- an agreement on work activity (also suitable for persons other than students).

The employer is required to enter into one of the above agreements with the trainee. The employer is also required to familiarise the trainee with the working environment, labour legislation and legislation applicable to the work to be performed by the trainee, as well as occupational health and safety regulations. Furthermore, the employer is required to create conditions for the proper performance of the tasks to be performed by the trainee under the agreement, naturally, under the supervision of a mentor.

It is up to the provider of the traineeship to decide whether to remunerate the trainee for his/her activity. Both paid and unpaid traineeships come into consideration. The duration of traineeships may vary, depending on the field or employer. The unwritten rule is that unpaid traineeships are shorter (weeks to months) and paid traineeships are longer (months to years). The duration of the traineeship is determined by the employer.

Eligibility

There are no restrictions on traineeships for citizens of other EU/EEA countries.

Implementation

There is currently no legislation in force in Slovakia relating to traineeships.

Living and Working conditions

The National Scholarship Programme of the Slovak Republic is designed to support the mobility of foreign and domestic students, doctoral candidates, university teachers, researchers and arts staff. Check with your educational institution or the organisation that arranged your traineeship to find out about the various trainee support programmes.

Where to find opportunities

Universities and international student organisations, such as AIESEC, IAESTE and ELSA, help students to find a traineeship. The Erasmus+ programme offers students the opportunity to undertake traineeships. Traineeship offers are available on some job portals, dedicated traineeship portals or on company websites.

If you are interested in undertaking a traineeship in a particular company, send them your CV with an application for a traineeship.

Funding and support

For information on traineeships and Erasmus+ grant opportunities, contact your university.

Links:

| AIESEC | https://aiesec.org |

| IAESTE | https://www.iaeste.sk |

| Universities in the Slovak Republic | https://www.minedu.sk/vysoke-skoly-v-slovenskej-republike |

| ELSA | https://www.elsa.sk |

| Erasmus+ programme | https://www.erasmusplus.sk |

| Traineeships | https://www.erasmusintern.org |

| National Scholarship Programme of the Slovak Republic | https://www.stipendia.sk |

| Employment services | https://www.sluzbyzamestnanosti.gov.sk |

| Job portal | https://www.profesia.sk/praca/internship-sta |

Where to advertise opportunities

Traineeship offers can be advertised on certain job portals and dedicated traineeship portals.

Assistance in finding candidates for internships can be provided by universities and international student organizations such as AIESEC, IAESTE and ELSA.

Funding and support

For information about funding and support for transnational trainees, you can contact universities, the national Erasmus+ agency, international student organisations, such as AIESEC, IAESTE or ELSA.

Links:

| AIESEC | https://aiesec.org |

| IAESTE | https://iaeste.sk |

| ELSA | https://elsa.sk |

| Erasmus+ programme | https://www.erasmusplus.sk |

| Traineeships | https://erasmusintern.org |

| Employment services | https://www.sluzbyzamestnanosti.gov.sk |

| Job portal | https://www.profesia.sk/praca/internship-staz |

Legal framework

Act No 61/2015 on vocational education and training and amending certain acts regulates vocational education and training of pupils in vocational secondary schools, types of vocational secondary schools, practical teaching, the dual education system, mutual rights and obligations.

The Act defines the following types of vocational secondary schools: secondary vocational school, secondary technical school, secondary medical school, business academy, hotel academy, secondary police vocational school and secondary fire protection school.

Coordination of vocational education and training for the labour market takes place at the national level and at the level of self-governing regions.

Description of schemes

The Schools Act allows for various forms of education to acquire lower secondary vocational education, secondary vocational education, complete secondary vocational education or higher vocational education (post-secondary or tertiary).

Students are provided practical instruction in the form of practical training, on-site training or practical exercises. In the dual education system, students are provided practical instruction directly on the employer’s site in a practical training centre or a workshop, but the number of practical training lessons in the workshop must not exceed 50% of the total number of practical training lessons.

The dual education system creates a partnership between the employer and the student, which is defined in the form of an apprenticeship contract and a relationship between the employer and the school in the form of a dual education contract. The entire practical training process (the organisation, content and quality of practical training provided to the student) is the responsibility of the employer, who also bears all the costs associated with it. Employers can join the dual education system after their eligibility has been verified (an application is submitted to the relevant trade or professional organisation). Employers are issued a certificate for a period of 7 years. Employers can enter into a dual education contract with multiple secondary vocational schools. Secondary vocational schools can enter into a dual education contract with multiple employers.

Employers receive a contribution from the budget of the Slovak Ministry of Education, Science, Research and Sport for the provision of practical instruction.

Students are required to attend practical training under the guidance of a vocational training master, practical training teacher, head instructor or instructor. Students are paid for each hour of productive work at a rate of at least 50% of the hourly minimum wage. The quality of the student’s work and the student’s conduct are also taken into account in determining the amount. In occupations with a shortage of graduates on the labour market, students receive incentive scholarships of 65%, 45% or 25% of the minimum subsistence amount, depending on their school results. Employers may pay students a monthly scholarship during the school year, up to a maximum of four times the minimum subsistence amount.

The recognition of qualifications in Slovakia is governed by Act No 422/2015 on the recognition of evidence of formal education and recognition of professional qualifications. It covers the recognition of documents issued by educational institutions in EU and EEA Member States, Switzerland and third countries. The roles related to this are performed by the Ministry of Education. Information about enrolment in secondary schools and the recognition of qualifications is available on the Central Public Administration Portal.

Key organisations:

Ministry of Education, Science, Research and Sport

Self-governing regions

Trade and professional organisations and trade union associations

Eligibility

Information about the availability of education to EU citizens and foreign nationals in Slovakia can be found on the Central Public Administration Portal. EU citizens submit an application to the secondary school and present evidence of formal education or diplomas from competitions. The recognition of evidence of formal education, which is a certificate with the relevant supplement issued by a primary school in another Member State or a third country for the purpose of continuing studies, is subject to a decision of the district office in the relevant regional capital based on a comparison of the content and scope of the education received with that required in Slovakia according to the national curriculum. (Act No 422/2015).

Living and Working conditions

Employers in Slovakia are encouraged to participate in vocational education and training through tax incentives. The advantage of dual education is that students acquire work habits already during their studies, which shortens the period of their adaptation after taking up employment. They achieve the required work performance faster and receive better remuneration. Students have the option to enter into a future employment contract with the employer as part of their apprenticeship contract.

Students who are interested in dual education choose the field they wish to study and the employer by whom they wish to be interviewed. If successful in the selection procedure, the students receive a certificate of vocational education and training in the dual education system. The students attach this certificate to their school application and then sit the admission examination. Before starting their studies, students enter into an apprenticeship contract with the employer (the contract can be concluded until the end of the semester of the first year).

Where to find opportunities

Information about secondary education in Slovakia can be found on the portal: www.stredneskoly.sk.

Information about the dual education system can be found on the website of the State Vocational Education Institute, the Secondary Vocational Education Portal and on the websites of employer chambers and associations.

Funding and support

The funding of secondary schools in Slovakia is based on the normative principle – the schools are funded according to the number of students and how demanding the educational process is in terms of personnel and costs. According to Act No 245/2008, education and training are based on the principle of free education in primary schools and secondary schools set up by a local education authority, a central government authority or a regional authority.

Further information about the funding of dual education can be found in point 3.1.2.

Where to advertise opportunities

In the media, on the Secondary Vocational Training Development website and on the websites of employer chambers and associations.

Funding and support

Employer chambers and associations, the State Vocational Education Institute.

Links:

| Ministry of Education, Science, Research and Sport | https://www.minedu.sk |

| State Vocational Education Institute – 1 | https://mojdual.sk |

| State Vocational Education Institute – 2 | https://dualnysystem.sk |

| Recognition of qualifications | https://www.minedu.sk/recognition-of-foreign-diplomas |

| Central Public Administration Portal | https://www.slovensko.sk/sk/titulna-stranka |

| Self-governing regions | https://www.e-vuc.sk |

| Secondary schools. | https://www.stredneskoly.sk |

| Secondary vocational education portal – rsov.iedu.sk | https://rsov.iedu.sk |

| Employer chambers and associations – szk.sk | https://www.szk.sk |

| Employer chambers and associations – banskakomora.sk | https://www.banskakomora.sk |

| Employer chambers and associations – sppk.sk | https://www.sppk.sk |

| Employer chambers and associations – azzz.sk | https://www.azzz.sk |

| Employer chambers and associations – sopk.sk | https://www.sopk.sk |

| Employer chambers and associations – slsk.sk | https://www.slsk.sk |

The free movement of goods is one of the cornerstones of the European Single Market.

The removal of national barriers to the free movement of goods within the EU is one of the principles enshrined in the EU Treaties. From a traditionally protectionist starting point, the countries of the EU have continuously been lifting restrictions to form a ‘common’ or single market. This commitment to create a European trading area without frontiers has led to the creation of more wealth and new jobs, and has globally established the EU as a world trading player alongside the United States and Japan.

Despite Europe’s commitment to breaking down all internal trade barriers, not all sectors of the economy have been harmonised. The European Union decided to regulate at a European level sectors which might impose a higher risk for Europe’s citizens – such as pharmaceuticals or construction products. The majority of products (considered a ‘lower risk’) are subject to the application of the so-called principle of mutual recognition, which means that essentially every product legally manufactured or marketed in one of the Member States can be freely moved and traded within the EU internal market.

Limits to the free movement of goods

The EU Treaty gives Member States the right to set limits to the free movement of goods when there is a specific common interest such as protection of the environment, citizens’ health, or public policy, to name a few. This means for example that if the import of a product is seen by a Member State’s national authorities as a potential threat to public health, public morality or public policy, it can deny or restrict access to its market. Examples of such products are genetically modified food or certain energy drinks.

Even though there are generally no limitations for the purchase of goods in another Member State, as long as they are for personal use, there is a series of European restrictions for specific categories of products, such as alcohol and tobacco.

Free movement of capital

Another essential condition for the functioning of the internal market is the free movement of capital. It is one of the four basic freedoms guaranteed by EU legislation and represents the basis of the integration of European financial markets. Europeans can now manage and invest their money in any EU Member State.

The liberalisation of capital markets has marked a crucial point in the process of economic and monetary integration in the EU. It was the first step towards the establishment of our European Economic and Monetary Union (EMU) and the common currency, the Euro.

Advantage

The principle of the free movement of capital not only increases the efficiency of financial markets within the Union, it also brings a series of advantages to EU citizens. Individuals can carry out a broad number of financial operations within the EU without major restrictions. For instance, individuals with few restrictions can

- easily open a bank account,

- buy shares

- invest, or

- purchase real estate

in another Member State. EU Companies can invest in, own and manage other European enterprises.

Exceptions

Certain exceptions to this principle apply both within the Member States and with third countries. They are mainly related to taxation, prudential supervision, public policy considerations, money laundering and financial sanctions agreed under the EU Common Foreign and Security Policy.

The European Commission is continuing to work on the completion of the free market for financial services, by implementing new strategies for financial integration in order to make it even easier for citizens and companies to manage their money within the EU.

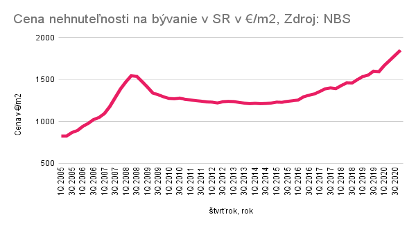

Many people in Slovakia live in privately-owned houses or flats. In urban areas, privately-owned flats and rented accommodation are the most common type of housing. In smaller towns and villages, people are more likely to live in houses. Accommodation in Slovakia is generally easy to find if you wish to buy a house or flat. Property prices in the capital and in university towns and their suburban areas are higher than in other regions. Regional and local newspapers are a good source of information about available accommodation. There are also private estate agencies, although these charge a fee for their services.

Types of housing:

- property – in personal ownership

- social – housing for disadvantaged groups of citizens

- private rent – renting flats for profit.

Buying a property: The price of property is often calculated on a price-per-square-metre basis. If you do not have enough capital, you may be eligible to apply for a loan to buy a flat or a house, or to build your own house. Banks and financial institutions provide loans to buy property in the form of mortgages.

To avoid unnecessary problems when buying property, you should consult the cadastral offices and the seller.

It is also advisable to involve an expert in the buying process. The expert should have practical experience of the sale and transfer of property rights, and be familiar with sales and other relevant contracts. Such a person might be an experienced estate agent or a solicitor.

The main steps required when buying a property are as follows:

- Verification of the property. First of all, it is essential to verify that the property or flat is not encumbered by any charges and that the seller is indeed the sole owner of the flat. If relevant, also check whether the co-sellers are actually the co-owners of the flat. You can obtain this information from the deed of title at the relevant land registry (cadastral) office.

- Preparing documents. If everything is in order, prepare all the necessary documentation for the conveyance of the property. The most important document is the purchase agreement.

Renting a property: There is also the option of renting, if you do not wish to buy a flat or house. Renting a house is not common practice; it is much more common to rent a flat. There are relatively good rental opportunities. It is possible to do so in any town in Slovakia. Information on renting can be found in the advertising sections of newspapers, on the internet, or directly from estate agencies, which can be found in every town. Please note, however, that estate agents charge a commission for their services. This type of accommodation is relatively expensive. Renting is most expensive in Bratislava, the capital of Slovakia, while in smaller towns the prices are more affordable but the range of accommodation is more limited than in the capital. In addition to rent, tenants are usually required to pay for utilities themselves, which means that the monthly cost of renting, especially in some towns, may effectively be doubled. Rent is normally paid monthly. A deposit of several months’ rent is usually required. It is standard procedure to sign a tenancy agreement.

Links:

| Accommodation in Slovakia – 1 | https://www.hauzi.sk |

| Accommodation in Slovakia – 2 | https://www.slovakia.com |

| Flats to rent | https://www.byty.sk |

| Purchasing a property – 1 | https://www.nehnutelnosti.sk |

| Purchasing a property – 2 | https://www.ringo.topky.sk |

Education at nursery schools, primary schools, secondary schools, primary art schools, language schools, schools for children and students with special educational needs, and school facilities is provided in accordance with Act No 245/2008 on instruction and education (the Schools Act) and amending certain acts, as amended. Education at universities takes place in accordance with Act No 131/2002 The Act on Universities and on amendments to certain acts.

The Education section of the Ministry of Education website provides up-to-date information on preschool education, primary education, secondary education, higher education, national education, lifelong learning, the youth, special and inclusive education, education in primary art schools, language schools, private and ecclesiastical schools and other areas of education.

A list of nursery schools, primary schools and primary art schools can be found on the websites of each city. A list of colleges and universities can be found on the Ministry of Education’s website under Education, Higher Education.

In larger towns, you may also obtain information from municipal information centres.

Links:

| Slovak Centre of Scientific and Technical Information. | https://www.cvtisr.sk |

| Ministerstvo školstva SR [Ministry of Education of the Slovak Republic], also in English | https://www.minedu.sk |

| Slovenská akademická informačná agentúra [Slovak Academic Information Agency] | https://www.saia.sk |

| National Scholarship Programme of the Slovak Republic | https://www.stipendia.sk |

| International Visegrad Fund | https://www.visegradfund.org |

| Slovak business directory | https://www.greenpages.sk |

| NIVAM National Institute of Education and Youth | https://www.nivam.sk |

The implementation of the principle of free movement of people, is one of the cornerstones of our European construction, has meant the introduction a series of practical rules to ensure that citizens can travel freely and easily to any Member State of the European Union. Travelling across the EU with one’s car has become a lot less problematic. The European Commission has set a series of common regulations governing the mutual recognition of driving licences, the validity of car insurance, and the possibility of registering your car in a host country.

Your driving licence in the EU

The EU has introduced a harmonised licence model and further minimum requirements for obtaining a licence. This should help to keep unsafe drivers off Europe's roads - wherever they take their driving test.

Since 19 January 2013, all driving licences issued by EU countries have the same look and feel. The licences are printed on a piece of plastic that has the size and shape of a credit card.

Harmonised administrative validity periods for the driving licence document have been introduced which are between 10 and 15 years for motorcycles and passenger cars. This enables the authorities to regularly update the driving licence document with new security features that will make it harder to forge or tamper - so unqualified or banned drivers will find it harder to fool the authorities, in their own country or elsewhere in the EU.

The new European driving licence is also protecting vulnerable road users by introducing progressive access for motorbikes and other powered two-wheelers. The "progressive access" system means that riders will need experience with a less powerful bike before they go on to bigger machines. Mopeds will also constitute a separate category called AM.

You must apply for a licence in the country where you usually or regularly live. As a general rule, it is the country where you live for at least 185 days each calendar year because of personal or work-related ties.

If you have personal/work-related ties in 2 or more EU countries, your place of usual residence is the place where you have personal ties, as long as you go back regularly. You don't need to meet this last condition if you are living in an EU country to carry out a task for a fixed period of time.

If you move to another EU country to go to college or university, your place of usual residence doesn't change. However, you can apply for a driving licence in your host country if you can prove you have been studying there for at least 6 months.

Registering your car in the host country

If you move permanently to another EU country and take your car with you, you should register your car and pay car-related taxes in your new country.

There are no common EU rules on vehicle registration and related taxes. Some countries have tax-exemption rules for vehicle registration when moving with the car from one country to another permanently.

To benefit from a tax exemption, you must check the applicable deadlines and conditions in the country you wish to move to.

Check the exact rules and deadlines with the national authorities: https://europa.eu/youreurope/citizens/vehicles/registration/registration-abroad/index_en.htm

Car Insurance

EU citizens can insure their car in any EU country, as long as the chosen insurance company is licensed by the host national authority to issue the relevant insurance policies. A company based in another Member State is entitled sell a policy for compulsory civil liability only if certain conditions are met. Insurance will be valid throughout the Union, no matter where the accident takes place.

Taxation

Value Added Tax or VAT on motor vehicles is ordinarily paid in the country where the car is purchased, although under certain conditions, VAT is paid in the country of destination.

More information on the rules which apply when a vehicle is acquired in one EU Member State and is intended to be registered in another EU Member State is available on this link https://europa.eu/youreurope/citizens/vehicles/registration/taxes-abroad/index_en.htm.

EU/EEA citizens only require a valid travel document (a passport or identity card) to enter Slovakia. Conditions governing foreign nationals’ entry into Slovakia and their residence here are governed by Act No 404/2011 on the residence of foreign nationals and amending certain acts, effective from 1 January 2012.

EU/EEA and Swiss citizens may stay in Slovakia for longer than three months if they:

- are employed in Slovakia

- are self-employed in Slovakia

- are studying at a primary or secondary school or at a higher education institution in Slovakia

- have sufficient funds to cover their stay and that of their family members, and they have health insurance in Slovakia

- are likely to become employed

- are a family member of an EU/EEA citizen whom they have accompanied here and who fulfils the conditions listed above.

Reporting of residence

Within 10 business days of entering Slovakia, EU/EEA citizens are required to report their arrival date and place of residence here to the Immigration Police Department, unless this is done for them by the provider of their accommodation (their hotel). The relevant police department in their town of residence will require proof of address and/or the name and personal identification number of the person with whom they are staying.

Registration of residence in Slovakia

EU/EEA citizens staying in Slovakia for longer than three months must apply for their stay to be registered no later than 30 days after their first three months in the country have elapsed. There is an official form that needs to be filled in by those applying to be registered as residents free of charge. Applicants submit these forms, together with a valid identity card or travel document and documentation proving any of the facts listed above (an employment contract, a trade licence, a letter of confirmation from a school, a bank statement, etc.), in person at the Immigration Police Department.

On receipt of a complete application, the police department issues – on the same day – confirmation of the registration of residence of an EU/EEA citizen, stating their first name, surname and address, and the date of registration. If an EU/EEA citizen fails to submit proof of address, the address stated in the confirmation of registration will be considered the municipality where the EU/EEA citizen is going to stay.

EU/EEA citizens may apply for a 5-year residence permit (a plastic card) in person at their local Immigration Police Department in Slovakia. An EU/EEA citizen is required to submit a valid travel document or identity card, 2 photographs (3 x 3.5 cm) and evidence of accommodation with the residence permit application.

The right of permanent residence for EU citizens

EU/EEA citizens have the right of permanent residence once they have resided legally in Slovakia for a continuous period of 5 years. In certain cases it is possible to apply for permanent residence before the five-year period has elapsed.

The right of residence or the right of permanent residence for an EU/EEA citizen ceases to exist if:

- the person notifies the police department in writing that they are terminating their residence;

- he/she has been expelled from the country;

- the respective police department has deprived him/her of the right of residence or permanent residence;

- he/she has died or has been declared dead;

- has acquired national citizenship of the SR.

Links:

| Ministry of Foreign Affairs | https://www.mzv.sk |

| Ministry of the Interior | https://www.minv.sk |

| Central Public Administration Portal | https://portal.gov.sk |

| Migration Information Centre | https://www.mic.iom.sk/sk |

| Foreign Nationals Police Department | https://www.minv.sk/?vizova-info-typy-viz-1 |

In view of the epidemiological situation, find out about the pandemic measures and the situation at the borders in advance. Before arriving in a new country, the following formalities need to be taken into account:

- arrange accommodation (at least temporary accommodation);

- bring sufficient funds to live on until you receive your first pay cheque;

- find out what permits (related to residence and work) you need in Slovakia;

- if you have decided to work in another country, you should secure an employment contract before you arrive; you should check the working conditions, the wage amount, the wage payment method, requirements for the payment of compulsory contributions, the place of work, the type of work, the duration of your employment, etc.;

- find out whether it is necessary to have your qualifications recognised in the country where you want to work.

- Required documents:

- a valid passport / identity card;

- a driving licence;

- European Health Insurance Card;

- U1a U2 forms or other U forms that may be relevant to your situation;

- documents concerning your completed education and work experience (preferably with a certified Slovak translation);

- a CV in Slovak;

- several passport photos;

- general knowledge about your new country of residence.

Promptly after your arrival in Slovakia:

- if you are an EU citizen, notify the local police station of the arrival date, place and expected duration of your stay within 10 business days (if you are staying in a hotel, hostel or similar facility, this must be done by the accommodation provider); third-country nationals must do this within 3 days;

- if you plan to stay in Slovakia permanently, register your permanent residence at the local police station; for this, you will need a travel document and a document confirming where you are staying;

- ask the police station to issue a permanent residency card;

- if you are unemployed and you want to look for work, register with your local Office for Labour, Social Affairs and the Family (this is not compulsory);

- if you wish to transfer your unemployment benefits, register with your local Office of Labour, Social Affairs and Family within 7 days of your arrival, fill in a U2 form and submit it to the local branch of the Social Insurance Agency.

Links:

| Ministry of Foreign and European Affairs | https://mzv.sk/web/sk |

Quality of work and employment - a vital issue, with a strong economic and humanitarian impact

Good working conditions are important for the well-being of European workers. They

- contribute to the physical and psychological welfare of Europeans, and

- contribute to the economic performance of the EU.

From a humanitarian point of view, the quality of working environment has a strong influence on the overall work and life satisfaction of European workers.

From an economic point of view, high-quality job conditions are a driving force of economic growth and a foundation for the competitive position of the European Union. A high level of work satisfaction is an important factor for achieving high productivity of the EU economy.

It is therefore a core issue for the European Union to promote the creation and maintenance of a sustainable and pleasant working environment – one that promotes health and well-being of European employees and creates a good balance between work and non-work time.

Improving working conditions in Europe: an important objective for the European Union.

Ensuring favourable working conditions for European citizens is a priority for the EU. The European Union is therefore working together with national governments to ensure a pleasant and secure workplace environment. Support to Member States is provided through:

- the exchange of experience between different countries and common actions

- the establishment of the minimum requirements on working conditions and health and safety at work, to be applied all over the European Union

Criteria for quality of work and employment

In order to achieve sustainable working conditions, it is important to determine the main characteristics of a favourable working environment and thus the criteria for the quality of working conditions.

The European Foundation for the Improvement of Living and Working Conditions (Eurofound) in Dublin, is an EU agency that provides information, advice and expertise on, as the name implies, living and working conditions. This agency has established several criteria for job and employment quality, which include:

- health and well-being at the workplace – this is a vital criteria, since good working conditions suppose the prevention of health problems at the work place, decreasing the exposure to risk and improving work organisation

- reconciliation of working and non-working life – citizens should be given the chance to find a balance between the time spent at work and at leisure

- skills development – a quality job is one that gives possibilities for training, improvement and career opportunities

The work of Eurofound contributes to the planning and design of better living and working conditions in Europe.

Health and safety at work

The European Commission has undertaken a wide scope of activities to promote a healthy working environment in the EU Member States. Amongst others, it developed a Community Strategy for Health and Safety at Work for the period 2021-2027. This strategy was set up with the help of national authorities, social partners and NGOs. It addresses the changing needs in worker’s protection brought by the digital and green transitions, new forms of work and the COVID-19 pandemic. At the same time, the framework will continue to address traditional occupational safety and health risks, such as risks of accidents at work or exposure to hazardous chemicals.

The Community policy on health and safety at work aims at a long-lasting improvement of well-being of EU workers. It takes into account the physical, moral and social dimensions of working conditions, as well as the new challenges brought up by the enlargement of the European Union towards countries from Central and Eastern Europe. The introduction of EU standards for health and safety at the workplace, has contributed a lot to the improvement of the situation of workers in these countries.

Improving working conditions by setting minimum requirements common to all EU countries

Improving living and working conditions in the EU Member States depends largely on the establishment of common labour standards. EU labour laws and regulations have set the minimum requirements for a sustainable working environment and are now applied in all Member States. The improvement of these standards has strengthened workers’ rights and is one of the main achievements of the EU’s social policy.

The importance of transparency and mutual recognition of diplomas as a crucial complement to the free movement of workers

The possibility of obtaining recognition of one’s qualifications and competences can play a vital role in the decision to take up work in another EU country. It is therefore necessary to develop a European system that will guarantee the mutual acceptance of professional competences in different Member States. Only such a system will ensure that a lack of recognition of professional qualifications will not become an obstacle to workers’ mobility within the EU.

Main principles for the recognition of professional qualifications in the EU

As a basic principle, any EU citizen should be able to freely practice their profession in any Member State. Unfortunately the practical implementation of this principle is often hindered by national requirements for access to certain professions in the host country.

For the purpose of overcoming these differences, the EU has set up a system for the recognition of professional qualifications. Within the terms of this system, a distinction is made between regulated professions (professions for which certain qualifications are legally required) and professions that are not legally regulated in the host Member State.

Steps towards a transparency of qualifications in Europe

The European Union has taken important steps towards the objective of achieving transparency of qualifications in Europe:

- An increased co-operation in vocational education and training, with the intention to combine all instruments for transparency of certificates and diplomas, in one single, user-friendly tool. This includes, for example, the European CV or Europass Trainings.

- The development of concrete actions in the field of recognition and quality in vocational education and training.

Going beyond the differences in education and training systems throughout the EU

Education and training systems in the EU Member States still show substantial differences. The last enlargements of the EU, with different educational traditions, have further increased this diversity. This calls for a need to set up common rules to guarantee recognition of competences.

In order to overcome this diversity of national qualification standards, educational methods and training structures, the European Commission has put forward a series of instruments, aimed at ensuring better transparency and recognition of qualifications both for academic and professional purposes.

The European Qualifications Framework is a key priority for the European Commission in the process of recognition of professional competences. The main objective of the framework is to create links between the different national qualification systems and guarantee a smooth transfer and recognition of diplomas.

A network of National Academic Recognition Information Centres was established in 1984 at the initiative of the European Commission. The NARICs provide advice on the academic recognition of periods of study abroad. Located in all EU Member States as well as in the countries of the European Economic Area, NARICs play a vital role the process of recognition of qualifications in the EU.

The European Credit Transfer System aims at facilitating the recognition of periods of study abroad. Introduced in 1989, it functions by describing an education programme and attaching credits to its components. It is a key complement to the highly acclaimed student mobility programme Erasmus.

Europass is an instrument for ensuring the transparency of professional skills. It is composed of five standardised documents

- a CV (Curriculum Vitae),

- a cover letter editor,

- certificate supplements,

- diploma supplements, and

- a Europass-Mobility document.

The Europass system makes skills and qualifications clearly and easily understood in the different parts of Europe. In every country of the European Union and the European Economic Area, national Europass centres have been established as the primary contact points for people seeking for information about the Europass system.

The majority of employment contracts in Slovakia are permanent.

Employment is of indefinite duration, unless the employment contract expressly specifies the duration or if the employment contract or an amendment to it does not fulfil the statutory requirements for fixed-term employment. Employment is also of indefinite duration unless an agreement concerning a fixed-term basis is drawn up in writing.

Fixed-term employment may be agreed for a maximum of 2 years. Fixed-term employment may be extended or renewed for a two-year period no more than twice.

Employment beginning less than 6 months after the end of any previous fixed-term employment between the same parties is treated as the renewal of that fixed-term employment.

The further extension or renewal of employment for a fixed period of up to or more than 2 years is possible only on the following grounds:

- for covering an employee during maternity leave, parental leave, leave immediately following maternity leave or parental leave, temporary incapacity to work, or an employee seconded long-term to perform a public function or trade union function;

- for work where it is necessary to significantly increase the number of employees for a transitional period not exceeding 8 months per calendar year;

- for work that linked to certain seasons and is repeated every year and does not exceed 8 months in any calendar year (seasonal work);

- for work covered by a collective agreement.

The reason for extending or renewing employment is stated in the employment contract.

Further extension or renewal of the employment relationship for a fixed period of up to two years – or over three years for a university lecturer or creative employee in science, research and development – is also possible if there is an objective reason based on the nature of the work of the university lecturer or creative employee in science, research and development, specified by separate legislation.

An employment relationship with a shorter working time

In the employment contract, the employer may agree working hours shorter than the designated working week with the employee. The employer may agree with the employee to change the established weekly working hours to shorter working hours or to change a shorter working week to the established weekly working hours.

The shorter working time need not be spread over all working days.

An employee in an employment relationship with a shorter working time will receive wages corresponding to the agreed shorter working time.

An employee employed for a shorter working time may not be favoured or disadvantaged in comparison with other employees.

Job sharing

A job-sharing post is one in which employees in an employment relationship with shorter working time allocate among themselves the working hours and workload attributed to that post.

Working from home and teleworking

Where work that could be carried out at the employer’s place of work is carried out on a regular basis within a fixed weekly working time, or part thereof, from the employee’s household, it is work from home or teleworking if the work is carried out using information technology that regularly involves remote electronic data transmission.

Work done by the employee on an occasional basis or in exceptional circumstances, with the employer’s consent or following agreement with the employer, at home or at a place other than that of the usual place of work, cannot be deemed to constitute working from home or teleworking, subject to the condition that the type of work that the employee does under the employment contract allows this.

The employer’s agreement with the employee in the employment contract is required for the performance of work from home or teleworking.

An employee performing work from home or teleworking shall not be favoured or restricted in comparison with a comparable employee with the place of work at the employer’s place of work.

Employees doing religious work

Provisions on working time and on collective labour-law relations do not apply to the labour-law relations for employees of churches and religious communities who do religious work.

An employment contract with a student of a secondary vocational college or a secondary apprenticeship school

An employer may conclude an agreement on a future employment contract with a student of a secondary vocational college or a student of a secondary apprenticeship school, no earlier than the date on which the student reaches 15 years of age. The agreement can be a commitment by the employer to accept the student into an employment relationship after the final examination, baccalaureate-level exam or graduation test, and a commitment by the student to become an employee of the employer. In this case, no probation period may be agreed. The type of work agreed must correspond to the qualifications obtained by the student upon completion of the field of training or study. The agreement on the future employment contract must be concluded with the consent of the student’s legal guardian, otherwise it is invalid.

An agreement on a future employment contract must include a commitment by the student of the secondary vocational school or secondary apprenticeship school to remain, on completion of their final exams, in the employment of the employer for a fixed term of not more than three years. Otherwise the employer may demand that the student reimburse the costs incurred in training them in the relevant field of study.

Agreements on work performed outside an employment relationship (independent contractor agreements)

In exceptional cases, in order to get their tasks performed or meet their needs and requirements, employers may enter into independent contractor agreements (examples of which are known under Slovak law as an ‘agreement on the performance of work’ or an ‘agreement on casual student labour’) if the work is defined by the result it achieves (an ‘agreement on the performance of work’) or if it concerns occasional activity defined by the type of work (an ‘agreement on work activity’ or an ‘agreement on casual student labour’).

Seasonal work

Seasonal work for the purposes of a work-related agreement for the performance of seasonal work is a work activity which is dependent on the rotation of the seasons, is repeated each year and does not exceed eight months in a calendar year, in agriculture during cultivation, harvesting, sorting and storage, in tourism, in the food sector in the processing of agricultural products, and in forestry.

Links:

| Labour Code | No 311/2001 |

Prior to concluding an employment contract, the employer is required to inform the individual of their rights and obligations arising from the employment contract, and the working and remuneration conditions. An employment relationship is based on a written employment contract between the employer and the employee. Employment is established as of the date agreed in the employment contract as the work start date. The employment contract must be concluded on the basis of the Labour Code. The employer is required to issue one written copy of the employment contract to the employee. In the employment contract, the employer is required to agree with the employee on essential particulars, such as: the type of work for which the employee has been recruited, a brief job description, the place of work (the municipality, part of municipality or other specified place), the work start date and wage conditions, unless already agreed in the collective agreement. In the employment contract, the employer must also state other working conditions, including paydays, working hours, holiday allowance and notice period. The employment contract may also specify conditions that the parties wish to include, in particular bonuses or benefits in kind. A valid employment contract must be concluded no later than the start of employment (first day of work).

If work is to be carried out in another country and the duration of employment abroad exceeds one month, the length of the work abroad, currency of the salary or relevant part of the salary, other monetary benefits or benefits in kind related to the work abroad, and any terms and conditions concerning the return of the employee from abroad are specified by the employer in the employment contract.

Probation period

The employment contract may specify a probation period, which may not be more than 3 months, and in the case of a manager directly reporting to the statutory body or a member of the statutory body, and a manager directly reporting to such a manager, the probation period is a maximum of 6 months. A probation period may not be extended. The probation period will be extended for the duration of any time that the employee is unable to work. The probation period must be agreed on in writing, otherwise it is invalid. It is not possible to agree a probation period when renewing a fixed-term employment contract.

Amendments to an employment contract

The agreed content of an employment contract may be amended only if the employer and employee agree on the changes. Any amendment to an employment contract must be made in writing by the employer.

Links:

| Labour Code | https://www.employment.gov.sk/sk/legislativa/pracovna-legislativa/zakon… |

| National Labour Inspectorate | https://www.ip.gov.sk/pracovna-zmluva |

Employment of women

Women are entitled to the same treatment as men regarding access to employment, remuneration, promotion, professional training and working conditions. Employment and labour relations are generally governed by the Labour Code, unless international regulations specify otherwise. Employers may not dismiss female employees during a protected period or during pregnancy, maternity leave or parental leave, or where a single-parent female employee is caring for a child under three years of age. The list of work forbidden to pregnant women and women after giving birth is regulated by Government Decree No. 272/2004. The employer is required temporarily to adjust working conditions in order to exclude any harmful factors. Any employer assigning employees to respective shifts is required to take the needs of pregnant women into account.

Employment of adolescents

An adolescent employee is an employee who is less than 18 years old. An employer may only employ a natural person who has reached the age of 15 and completed compulsory education. The exception is certain light work. This is work during involvement or cooperation in cultural performances and artistic performances, sporting events or advertising activities.

A young employee under 16 years old has a maximum working time of 30 hours per week, and an employee older than 16 has a maximum working time of 37.5 hours per week. This condition applies even if the employee works for multiple employers. The Labour Code also prohibits adolescent employees from working overtime, working at night, and carrying out types of work prohibited for adolescent employees.

Employment of persons with a disability

Under Act No 5/2004 on employment services and the amendment of certain acts (as amended), a citizen with a disability is a person recognised as disabled in accordance with a special rule. A person with a disability proves their disability and the percentage reduction in their capacity for gainful employment due to a physical, mental or behavioural disorder, by means of a decision or notification from the Social Insurance Agency or an assessment by a Social Security Unit, in accordance with a special rule.

Persons with a disability may find work directly with employers who are required by law to employ a certain percentage of employees with a disability, or to provide financial contributions for such purpose. They may find work through supported employment agencies or in sheltered workshops or workplaces. These bodies also assist employees (who are temporarily unable to do their current jobs for health reasons) with opportunities to learn new occupational skills. Government subsidies are available to help establish and run a sheltered workshop or workplace.

Pursuant to Section 158 of the Labour Code, the employer is required to:

employ a disabled employee in appropriate job positions and provide them with training or education in order to achieve any necessary qualifications, and take care of their career development; create conditions for job opportunities for disabled employees; improve workplace facilities so that disabled employees can achieve the same work results as other employees, if possible, and to facilitate their work as much as possible.

Links:

| Labour Code | https://www.zakonnik-prace.sk |

| Employment Services Act | Employment services – MoL SR (gov.sk) |

| Regulation of the Government of the Slovak Republic No 272/2004 | 272/2004 - Regulation of the Government of the Slovak Republic... - SLOV-LEX |

Self-employment is governed by Act No 455/1991 on trade licensing. Trades are a systematic activity that traders carry on independently, on their own account, under their own responsibility, and under statutory conditions with a view to making a profit. If you want to start a business, the Central Government Portal and the Ministry of the Interior (the trade licensing section) websites are helpful.

A natural person (sole trader) or a legal entity may carry on a trade if they meet statutory conditions. The general conditions for sole trading by natural persons are that they be aged 18 or over and have legal capacity and integrity. When applying for a trade licence, it is necessary to select the line of business. The Trading Act distinguishes between what are known as vocational, regulated and unqualified trades. The type of trade determines what professional competence is required to carry on that trade.

When notifying a trade, it is necessary to submit the identity card, public health insurance card of the insured person, documents proving professional competence if required, and an extract from the judicial register if a natural person is not a citizen of the Slovak Republic to the single contact point (hereinafter SCP) of the local Trade Licensing Department of the District Authority.

Along with the trade notification, the SCP registers the natural person (sole trader) with their health insurer and the tax authority.

A trade notification may also be submitted electronically by using the electronic services offered by the Central Government Portal. The fee for issuing a trade licence is EUR 7 for each unqualified trade, EUR 22 for each vocational or regulated trade, and EUR 5 for an extract from the Trade Licence Register. The contributions to the Social Insurance Agency that a starting sole trader is required to pay are specified once the trader has filed their first income tax return, and are income-related. . Jobseekers may qualify for a self-employment allowance from the Office of Labour, Social Affairs and Family.

Links:

| Social Insurance Agency | https://www.socpoist.sk |

| Commercial Register | https://www.orsr.sk |

| Trade Register | https://www.zrsr.sk |

| Slovak Chamber of Trades | https://www.szk.sk |

| Slovak Trades Federation | https://www.szz.sk |

| Central Public Administration Portal of the Slovak Republic | https://www.slovensko.sk/sk/agendy/agenda/_elektronicke-ohlasenie-zivno… |

| General Prosecutor’s Office of the Slovak Republic – Applications for criminal record certificates | https://www.genpro.gov.sk |

| Geodesy, Cartography and Cadastre Authority of the Slovak Republic – Deeds of Title | https://www.skgeodesy.sk |

| Financial Administration | https://www.financnasprava.sk |

| Všeobecná zdravotná poisťovňa [health insurer] | https://www.vszp.sk |

| Slovak Business Agency | https://www.sbagency.sk |

| SARIO Slovak Investment and Trade Development Agency | https://www.sario.sk |

| Ministry of the Interior of the Slovak Republic – trade licensing section | https://www.minv.sk/?zivnostenske-podnikanie |

| The Central Office of Labour, Social Affairs and Family – contribution to self-employed activity | https://www.upsvr.gov.sk/sluzby-zamestnanosti/nastroje-aktivnych-opatre… |

In Slovakia the statutory minimum wage is set by law and an implementing government regulation. The amount is based on the average earnings of employees in the previous year and adjusted by a factor indicated in an agreement between representatives of employers’ associations, trade unions and the government. In sectoral collective agreements (known as ‘higher-level collective agreements’) and company collective agreements between employer representatives and employees, a higher minimum wage may be negotiated. The minimum wage as of 1 January 2024 is EUR 750 per month for an employee remunerated by monthly salary and EUR 4.31 for each hour worked by an employee.

Pay conditions are set out in collective agreements negotiated between the employer and relevant trade union, or directly in the employment contract between the employer and employee. If the remuneration is not set out in a collective agreement, the employee is entitled to be paid a wage in accordance with the terms and conditions set out in the employment contract. As part of these pay conditions, the employer specifies in particular the forms of remuneration for employees, the basic wage component and other components of remuneration for work and the conditions for providing them. The basic wage component is the component provided according to the time worked or performance achieved. The wage must not be less than the minimum wage set by the special rule.

In addition to these entitlements, the Labour Code also guarantees specific financial compensation for overtime, for work on public and national holidays, for work at night, or for work in conditions harmful to health, as classified by an independent authority for health protection. Such compensation is provided in the form of a wage supplement. When wages are paid, the employer is required to issue the employee with a written statement itemising the wage components, the deductions and the total cost of the work. The document shall be provided in paper form, unless the employer agrees with the employee that it be provided by electronic means. The total cost of work comprises the wage and related allowances (including compensation for being on standby to work) and, in particular, contributions to cover health insurance, sickness insurance, pension insurance, disability insurance, unemployment insurance, guarantee insurance, accident insurance, solidarity reserve fund and any pension fund contributions that the employer pays. At the employee’s request, the employer is required to provide access to the documentation used to calculate the wage.

The employer deducts tax monthly on behalf of employees. Income tax rates: 19 % of that part of the taxable income not exceeding EUR 47 537.98 per year (i.e. 176.8 times the current subsistence level) and 25 % of that part of the taxable income exceeding EUR 47 537.98 per year. When the calendar year has ended, employees are required to settle their income tax bill. They must either ask their employer to create an annual tax assessment for them (annual assessment of tax advances from the income of a natural person from dependent activity) or must submit a tax declaration on their own.

The employer is required to deduct employee insurance contributions from an employee’s wages. Employers make the following deductions from employees’ wages as a matter of priority: social security contributions, public health insurance contributions, arrears arising from the annual assessment of public health insurance contributions, contributions to pension plans paid by employees under special legislation, advance tax payments, arrears of advance tax payments, outstanding tax balances, arrears of advance tax payments and taxes incurred through the fault of the taxpayer, including penalties, and any arrears arising from the annual assessment of advances on employment-related income tax. Wages are payable monthly in arrears. They are paid by the end of the following calendar month, unless agreed otherwise in the collective agreement or employment contract. The wage is paid on the pay day agreed in the employment contract or in the collective agreement. Employers pay wages to employees’ bank accounts so that the amount can be credited to the account on the specified pay day. Employers may provide advance wage payments on agreed dates in between pay days.

Links:

| Central portal for public services | https://slovensko.sk |

| Social Insurance Agency | https://socpoist.sk |

| Financial Administration | https://financnasprava.sk |

The statutory working week in Slovakia may not exceed 40 hours. Depending on the type of work, normal working hours may range from 37.5 to 40 hours a week. Employees normally work 5 days a week. The work break, of 30 minutes, is generally not included in working hours and employees are entitled to it if the work shift is longer than 6 hours. A different arrangement of weekly working hours may be set out in a collective agreement or employment contract. The Labour Code also provides for a minimum uninterrupted daily rest period of 12 hours in a 24-hour day, uninterrupted rest of 2 consecutive days per week, work on weekends and public holidays, work at night, and overtime. It is not the norm to work overtime and, if there is overtime, employees are entitled to additional compensation on top of their normal wage. However, if the employer and employee have agreed that the employee will take time off as recompense (time in lieu) for working overtime, the employee is not also entitled to wage compensation. The average weekly work time, including overtime, must not exceed 48 hours. There are also specific provisions regulating the working hours of adolescents, pregnant women, male or female employees caring for children and employees with reduced working capacity.

Employees in Slovakia are entitled to the following types of leave:

Annual leave – you are entitled to claim annual leave from your employer after working at least 60 days in a calendar year. If you do not work for the whole year (but at least 60 days) for your employer, you are entitled to pro rata annual leave.

The pro rata portion for each calendar month is calculated as 1/12th of the annual leave.

The Labour Code clearly stipulates that the basic annual leave allowance is a minimum of four weeks. Leave is a minimum of five weeks for employees who are at least 33 years old by the end of the current calendar year or who have a child in their permanent care. Teaching and professional staff, as defined in special legislation, university teachers, research and artistic staff of public or state universities and staff with at least a second-degree university education who carry out research, teaching, scientific or development activities are entitled to more annual leave than the basic annual leave allowance, namely annual leave of at least 8 weeks.

Annual leave for employees on flexitime arrangements – one day’s leave is considered to be the time corresponding to the average working time per day, which is derived from the employee’s stipulated weekly working hours and assumes a five-day week.

Leave for days worked – if your job at a particular employer lasts for fewer than 60 days before the end of the year, you are entitled to leave for days actually worked at a rate of one twelfth of annual leave for every 21 days worked during the current calendar year.

Supplementary leave – granted when the work is classified as particularly demanding or harmful to health. Legislation designates the workplaces or areas where this type of work is carried out. Employees who do such work for the entire calendar year are entitled to one week’s additional leave. If employees under these conditions work only part of a calendar year, they are entitled to pro rata leave, one twelfth of the supplementary leave for each 21 days worked. Additional leave must be taken, and it has priority over other leave; it is not possible to provide wage compensation for untaken leave.

Curtailment of leave – for any employees who have worked for at least 60 days in the calendar year, the employer may curtail by one twelfth the leave for the first 100 missed working days, and by a further twelfth for every additional 21 missed working days, if the employee did not work for reasons stipulated by the Labour Code (Section 109). The leave entitlement for the relevant calendar year may be curtailed only for reasons arising in that year.

For each shift (working day) missed without authorisation, the employer may curtail the employee’s leave by one or two days. Unauthorised absences for shorter parts of individual shifts are aggregated.

Maternity leave – lasting 34 weeks, (37 weeks for a single mother or 43 weeks if the mother gave birth to two or more children at once). As a rule, a woman takes maternity leave from the beginning of the sixth week before the expected date of the birth, but no earlier than the eighth week.

Paternity leave – in connection with care for a newborn, a man is entitled to 28 weeks of leave, a single man to 31 weeks of leave, and when caring for 2 or more newborns, to 37 weeks of leave.

Parental leave – employees may request parental leave from their employer in order to spend more time looking after their children. Employers must grant such a request. Parental leave is provided for as long as the parent requests it (as a rule for at least one month) until the child reaches three years of age. In the case of a long-term adverse health status of a child requiring special care, the employer is obliged to grant women and men, who request it, parental leave up to 6 years of the child’s age.

Paid leave to obtain more qualifications – this leave may be provided by the employer with pay amounting to the employee’s average earnings, especially if the qualifications to be obtained by the employee are relevant to the employer’s needs. ‘Obtaining more qualifications’ is also taken to mean the acquisition of new qualifications or an extension to existing qualifications.

Paid leave may also be granted for the following reasons:

- examination or treatment of an employee at a medical facility (maximum 7 days per calendar year);

- escorting a family member to a medical facility (maximum 7 days per calendar year), accompanying a disabled child to a social care institution or special school (maximum 10 days per calendar year);

- the birth of an employee’s child;

- the death of a family member;

- the employee’s own wedding;

- other serious reasons.

National and public holidays – days of continuous rest for employees during the week or on public holidays. Employees may be ordered to work on such days only in exceptional cases and after consultation with employee representatives.

On 1 January, 6 January, Good Friday, Easter Sunday, Easter Monday, 1 May, 8 May, 5 July, 29 August, 15 September, 1 November, 17 November, 24 December after 12 noon and on 25 and 26 December, an employee may not be ordered or agreed to do work involving the sale of goods to the final consumer, including related work, known as retail sales. Exempted from this rule are sales:

- of fuel and lubricants at petrol stations;

- and the dispensing of medicines at pharmacies;

- at airports, ports, other public transport facilities, and hospitals;

- of travel tickets;

- of souvenirs;

- of flowers on 8. 5. and the sale of flowers and objects intended for the decoration of grave site 1. 11.

National holidays:

1.1., 5.7., 29.8., 1.9. (not a non-working day), 28.10. (not a non-working day), 17.11.

Public holidays (other than Sundays):

6 January, Good Friday, Easter Monday, 1 May, 8 May, 15 September, 1 November, 24 December, 25 December, 26 December

The employer must pay a wage to the employee for national and public holidays.

Links:

| Government Office of the Slovak Republic – national holidays | https://www.vlada.gov.sk//statne-sviatky |

Employment may be terminated by:

- agreement;

- notice of termination;

- immediate dismissal;

- notice of termination during a probation period.

Any agreement to terminate an employment relationship between an employer and employee must be made in writing. Fixed-term employment ends when the agreed period expires. Either the employer or the employee may terminate the employment relationship by serving notice of termination, in writing and duly delivered, otherwise it is invalid. The notice period is at least 1 month. The Labour Code governs cases where the notice period may be longer.